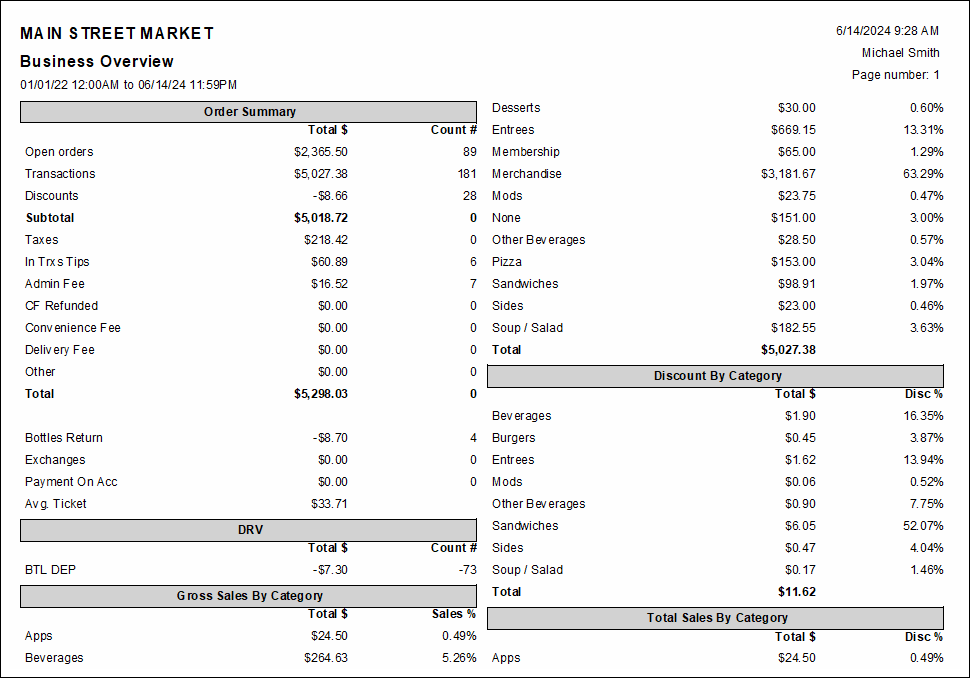

The Business Overview report provides a comprehensive snapshot of transactions from within a designated time period. These reports are of great importance for merchants as they include critical sales data impacting sales, orders, revenue, taxes, and much more.

Business Overview reports include data about order summaries, sales by category, discounts by category, taxes and other important business details.

- Note: Business Overview reports contain the same data as Snapshot Reports. See: Snapshot and Station Snapshot Reports.

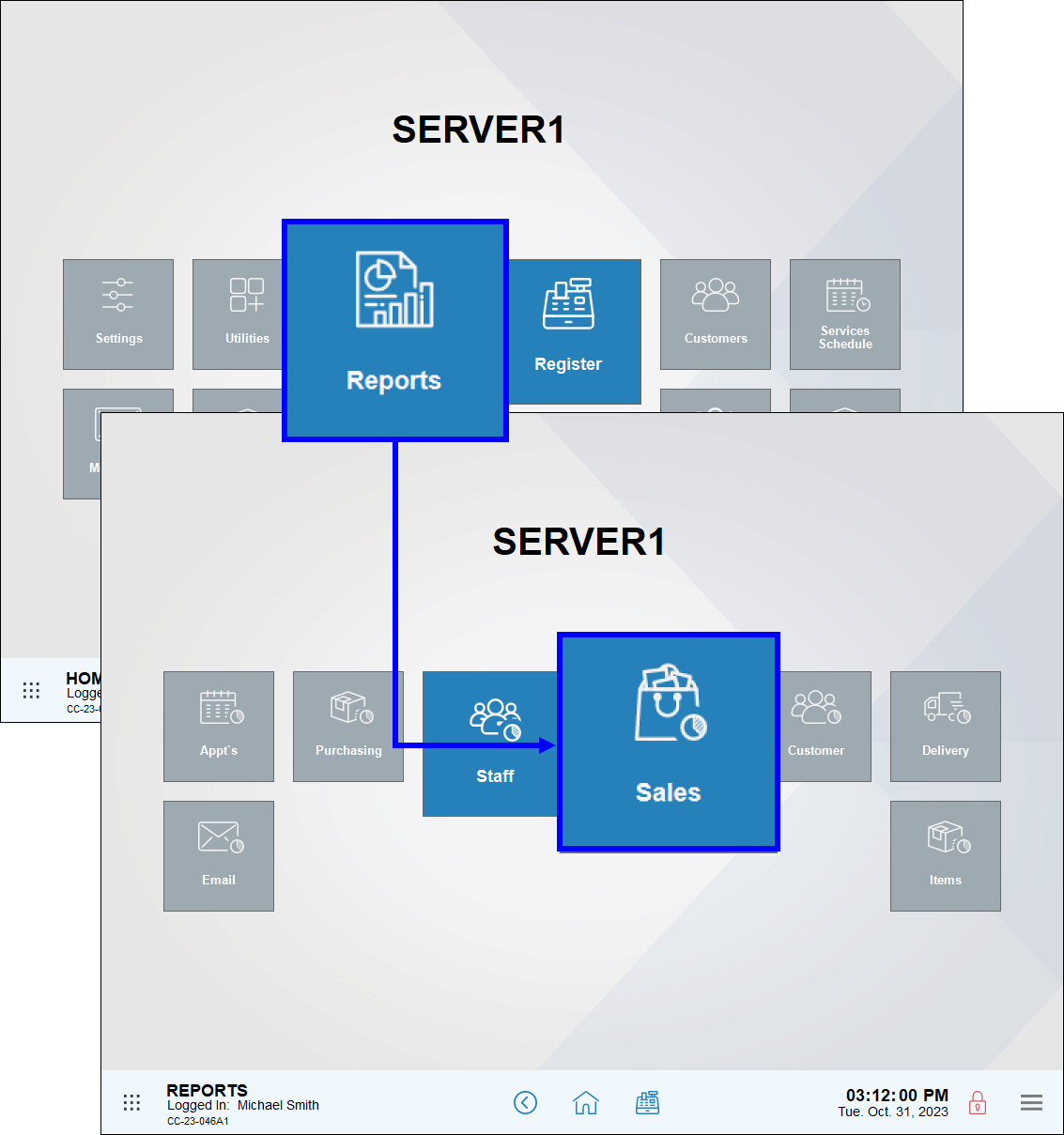

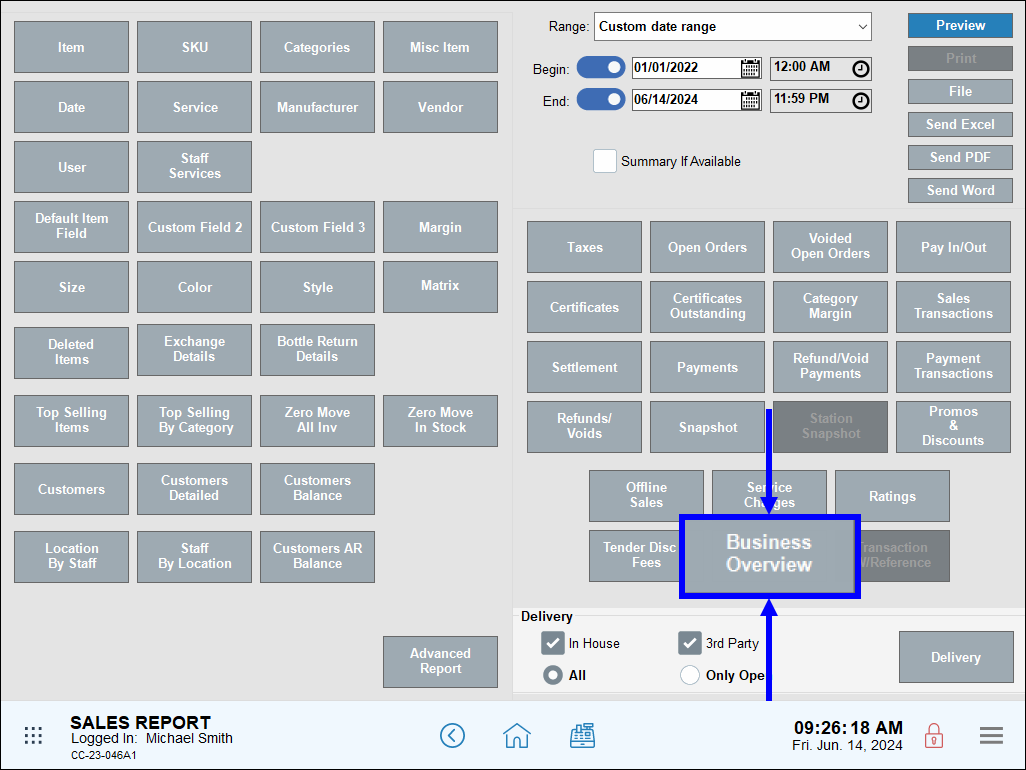

Perform the following to generate a Business Overview report:

- From Home, navigate to Reports > Sales.

- Configure the date Range or enter custom dates, as desired.

- Tap Business Overview.

- The Business Overview report displays. Review, send, or save the report as needed.

The Business Overview report provides a comprehensive overview of your business data for this station only

- Open Orders – Sum of all open orders. These orders can be viewed from the Get Order button within the Register. The reported total reflects any discounts except those applied due to tender type. The reported total does not reflect partial payments.

- Transactions – Sum of all items and services sold where payment is collected in full. This is the item total before any discounts or taxes.

- Discounts – Total of all dollar- and percentage-based discounts applied to orders. This includes all line item-, whole order- and tender-based discounts

- Subtotal – The difference between Transactions and Discounts

- Taxes – The sum of all tax groups collected after exemptions and refunds. The tax section at the bottom of the report displays taxes collected and refunded per group.

- In Trxs Tips – Sum of all in-transaction tips, applied via Tip Adjustments, Staff Declared Cash Tips, Add/Mod Tips, Touch CFD, or the TableTurn pay at the table device.

- Admin Fee – Adds all tender based fees set in Account settings

- Convenience Fee – Totals convenience fees generated through DeliverMe

- Delivery Fee – Sum of all in house and 3rd party delivery fees collected

- Other – Sum of other fees collected. This includes promo based fees defined as a percentage or dollar-base, and is set up in the Items Promos menu. Also included are CRV/DRV fees that are typically used for bottle deposit collection in retail.

- Total – Total collected from all transaction activity. This is not gross sales as defined by GAAP, since it includes tips, admin fees, delivery fees, and other fees collected during the transaction.

- Exchanges – Value and amount of all exchanged items

- Avg. Ticket – Average ticket amount based on count of “Transactions” and “Total” from Order Summary section

- Labor Cost – Hourly wages of all employees. Staff must have an hourly rate set and use the clock in/clock out features.

- Net Sales – Subtotal from Order Summary. Percentage displays how much of the Subtotal goes toward hourly wages.

- Sales – Taxes collected. The taxable amount used to derive total tax collected can be found on the Taxes report, and includes discounts applied to items. Depending on settings, it may also reflect service fees applied to orders.

- Refunds – Taxes refunded. The taxable amount used to derive total tax refunded can be found on the Taxes report, and includes discounts applied to items.

- Total – Difference between sales and refunded taxes collected for each group.

- Exempt – Any taxes exempt on an order. Based on payment method or customer status exemption.

- Declared – Tips entered when employee clocks out or as entered in the Delivery Manager

- Credit – Sum of all credit tips adjusted after sale is processed

- In Trxs Cash – Sum of all cash tips

- In Trxs Credit – Sum of all credit tips

- Total – Total of all tips accepted

- Cash – All cash accepted before pay ins and tips, and after refunds and voids

- Pay In – Pay in company

- Pay Out – Pay out company

- Cash Back – Pay out customer and cash back from check payments

- Net Cash/par – Cash total after Pay Out Company and Cash Back are removed and Pay In is added

- Pay Out Customer – Pay out customer

- 3rd Party Delivery – Delivery Services tender option in the Register on the Pay tab

- Certificate – Exatouch gift certificates

- Credit – Total credit before any tips

- Debit – total debit before any tips

- EBT – Total EBT

- eGift – Total eGift

- Reward – Loyalty Rewards point values used

- Declared Tip – Declared tips entered when clocking out or in Delivery Manager

- Credit Tip – Credit adjustments through Complete Auth

- eGift Tip – Tips applied on eGift cards.

- In Trxs Cash Tip – All cash tips accepted before checking out

- In Trxs Credit Tip – All credit tips accepted before checking out

- Total – Total of all tendered activity. Includes discounts, tax, tips, and fees

- Delivery Fee – Revenue from delivery fees

- Owed to House – Everything collected except non-cash tips, declared tips, in transaction tips, and customer payouts

- Owed to Staff – Total of credit tips, eGift tips, declared tips, tip in transactions and percent of delivery fee paid to driver.

- Est. Cash Deposit – Remaining cash after paying out tips, and a delivery fee percent to drivers if set. This is not including in transaction cash tips. This total does not include Declared Tips or In Trxs Cash Tips.

Order Summary

Sales By Category

Item total broken down by Category. This includes discounts applied, but not sales tax. It also excludes any tips or fees collected. The relative percentage reported is calculated against the sum of all categories.

In-Store Sales by Order Type

Displays sales by in-store order types in the register. This number is the sum of the Subtotal and Admin Fees applied. This total does not include tax.

Online Order Sales by Order Type

Online orders, such as DeliverMe sales. This number is the sum of subtotal and admin fees applied. This total does not include tax.

Sales by Staff

Sales broken down by staff member who has tendered the order. This total is a sum of subtotal, plus admin fees applied. This does not include tax.

Labor Tracking

Sales by Revenue Center

Total of items broken down by defined value for Revenue Center definition found on Item’s Details. This number includes discounts applied. If there is no Center defined, values will report as unclassified. See: Define Custom Variables.

Sales by Revenue Class

Total of items broken down by defined value for Revenue Class definition found on Item’s Details. This number includes discounts applied. If there is no Class defined, values will report as unclassified. See: Define Custom Variables.

Net Sales By Day Part

Item totals broken down by user created time boxes throughout the day. Reported figures include discounts. Day Parts are defined within the Snapshot tab under Print Settings. They are optional, and report along with the cumulative total.

Taxes

Payment Transactions

Reporting of all tenders collected. The reported numbers for each tender are based on total collected, inclusive of any discounts, tax, tips, and fees applied before or after tendering payment.

Company Pay Out Details

Pay Outs issued for the merchant such as supplies or paying a vendor. Each Pay Out type used will report on its own line. Pay Out Company reasons can be created under Preferences on the Custom Vars page. See: Define Custom Variables.

Company Pay In Details

Pay Ins accepted for the merchant such as change from paying a vendor. Each Pay Out type used will report on its own line. Pay In Company reasons can be created under Preferences on the Custom Vars page. See: Define Custom Variables.

Refunded Payments

Reports on refunds issued organized by tender. Total includes any discounts, tax, tips and fees before or after tendering payment. Refunds, while not calculated within order summary, are deducted from this section.

Voided Payments

Reports on voids issued organized by tender. Total includes any discounts, tax, tips, and fees applied before or after tendering payments. Voids, while not calculated within order summary, are deducted from this section.

Settlement

Reports credit/debit and EBT(where applicable) card payments collected and refunds. Includes all discounts, taxes, tips, and fees applied before or after tendering payment.

Credit Card Transactions

Breaks down card sales by card type, which make up the total reported in the Settlement section.

Online Credit Card Trans.

Card type break down accepted through DeliverMe.

Promotions

Totals all automatically applied promotions. Different promotions applied are listed individually. This includes item level promos, category level promos, and happy hour promos on items and services.

Discounts

Summary data of all discounts and promos. Discounts can be applied at the item level or entire order level. Value reported for promos should match the promotions section above.

Tips by Staff

Total of all cash and non-cash tips per employee.

Summary

How can we improve this information for you?

Registered internal users can comment. Merchants, have a suggestion? Tell us more.