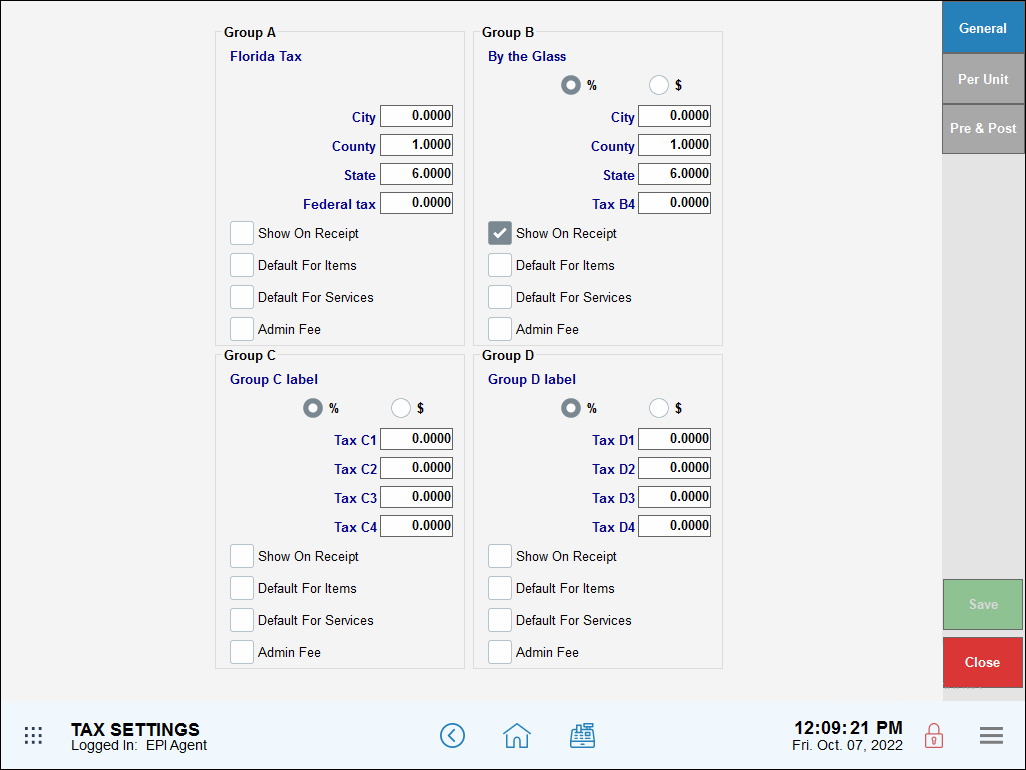

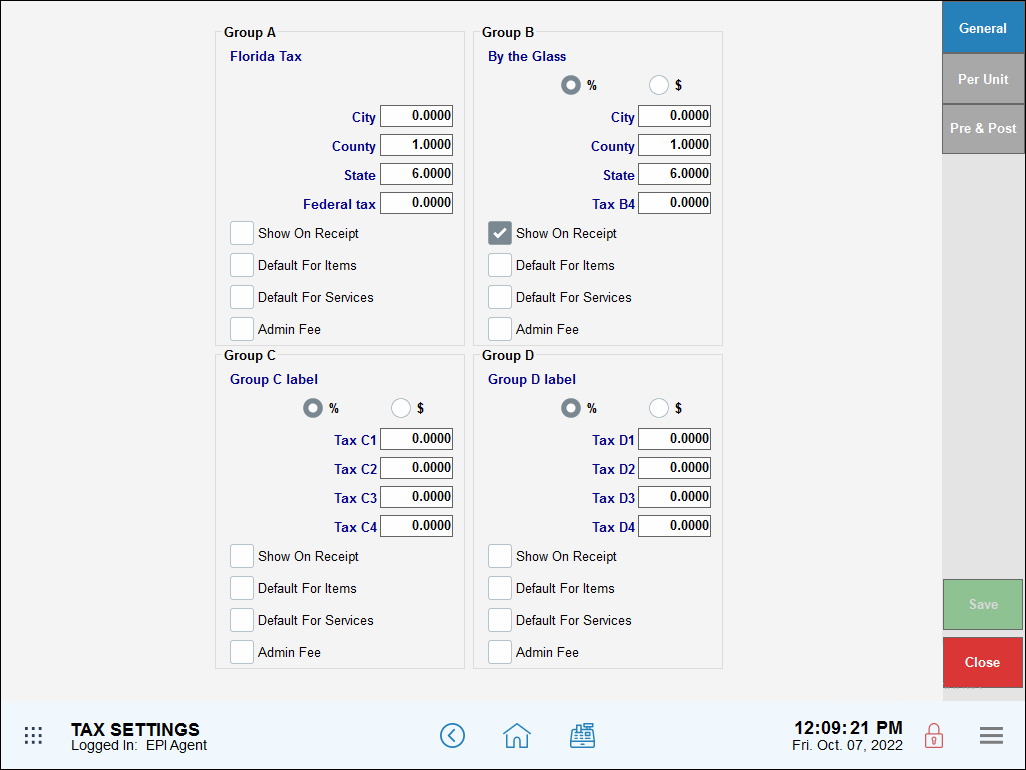

Tax rates are configured in Tax Group Settings. Tabs in Tax Group Settings correspond to different types of taxes: General, Per Unit, and Pre & Post. On each tab, tax rates are defined in Groups. Tax Groups are labeled alphabetically (i.e. Tax Group A, Tax Group B) but can be assigned custom labels as well.

General Taxes are set up on the General tab under Settings > Tax Group Settings. Tax Groups A, B, C, and D are designated for General Taxes.

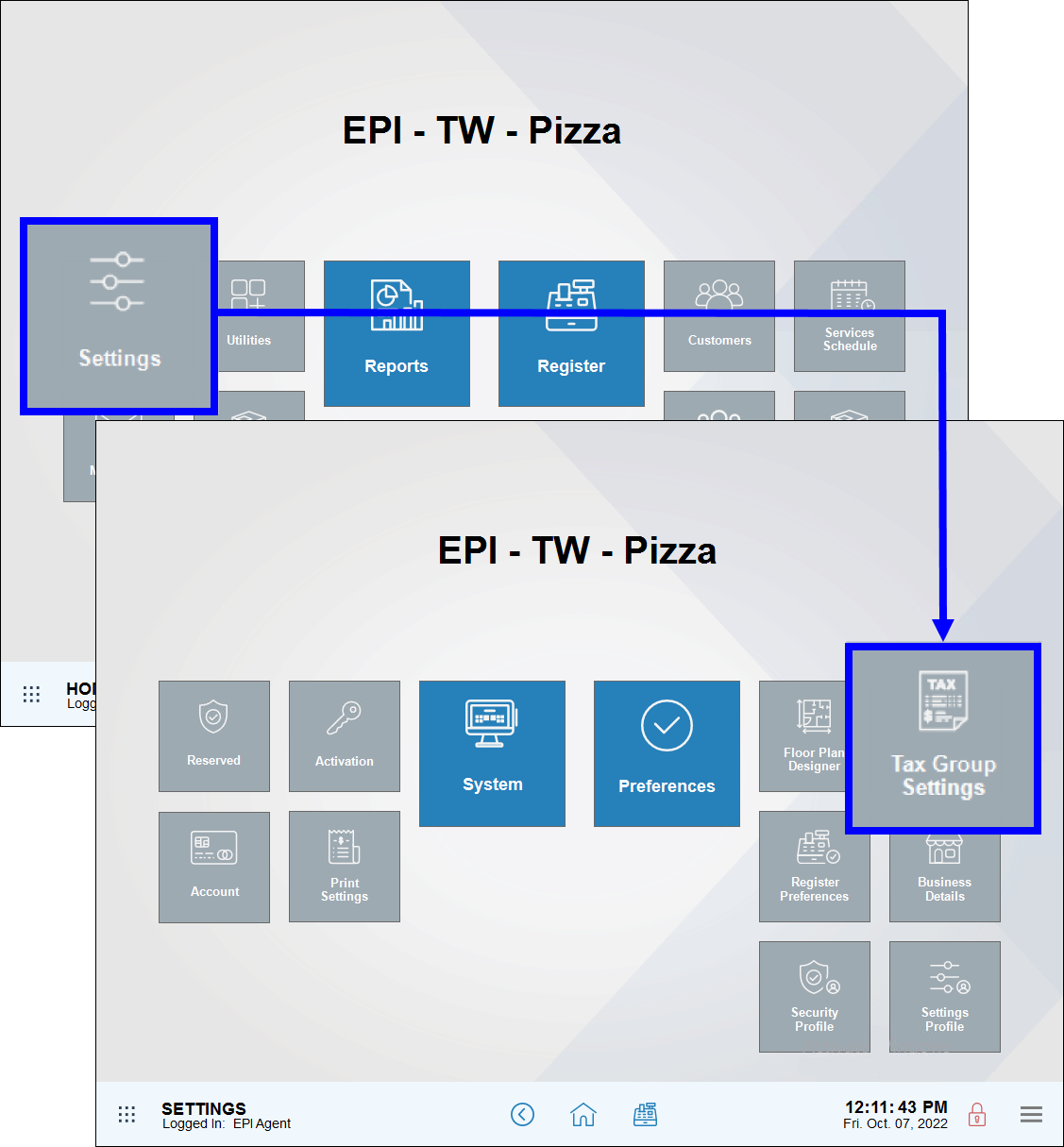

- From Home, navigate to Settings > Tax Group Settings.

- Confirm that the General tab displays.

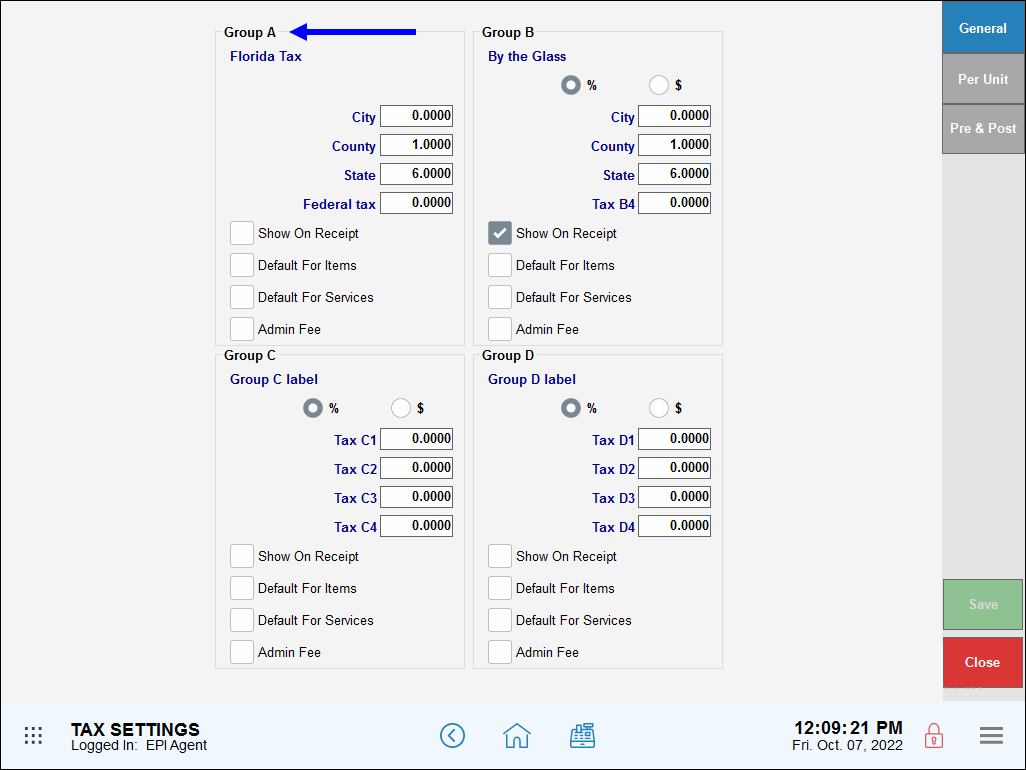

- Select a Tax Group to assign. Best practice is to configure the first available group. For example, configure Group A before Group B.

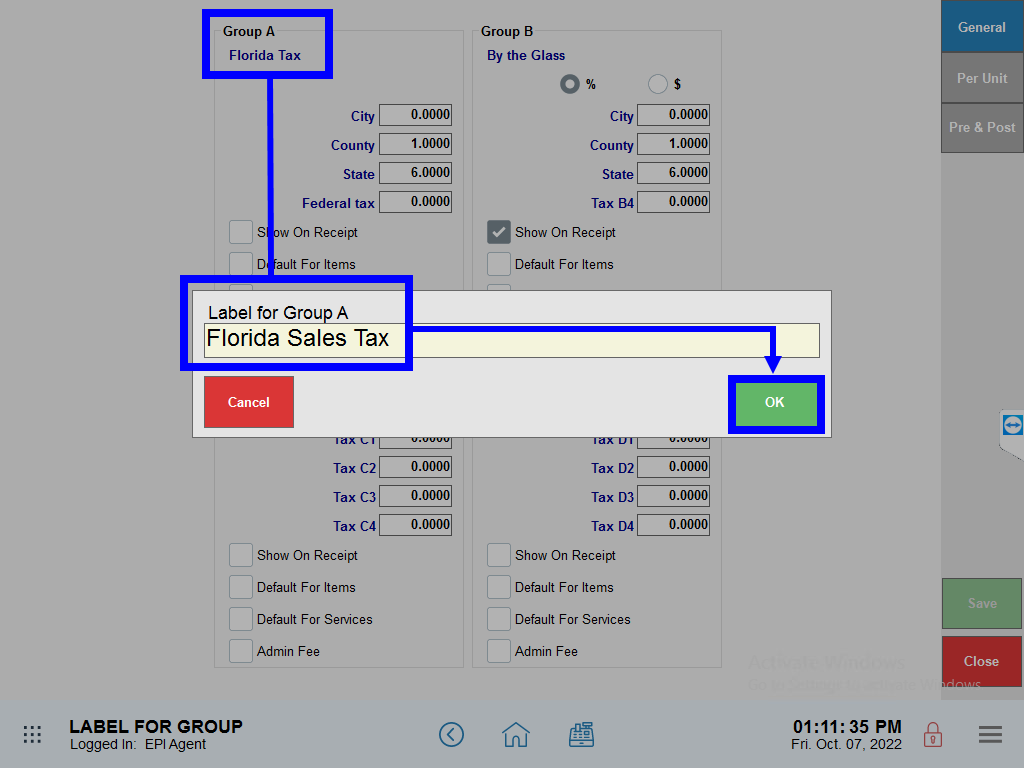

- Customize Tax Group names by selecting a generic label name and entering a new name in the pop-up, then tap OK. For example, change “Tax Group A” to “FL State PB County”.

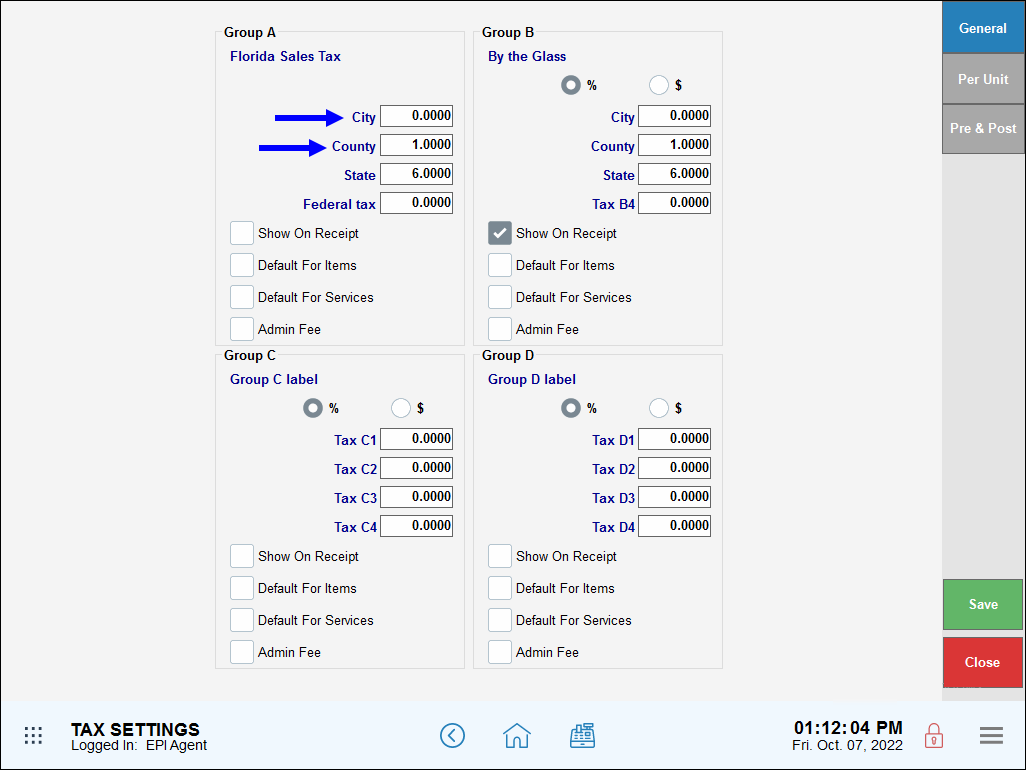

- Customize the names of individual taxes by clicking on a generic label name and typing in a name. For example, change Tax A1 to City Tax. Change Tax A2 to County Tax.

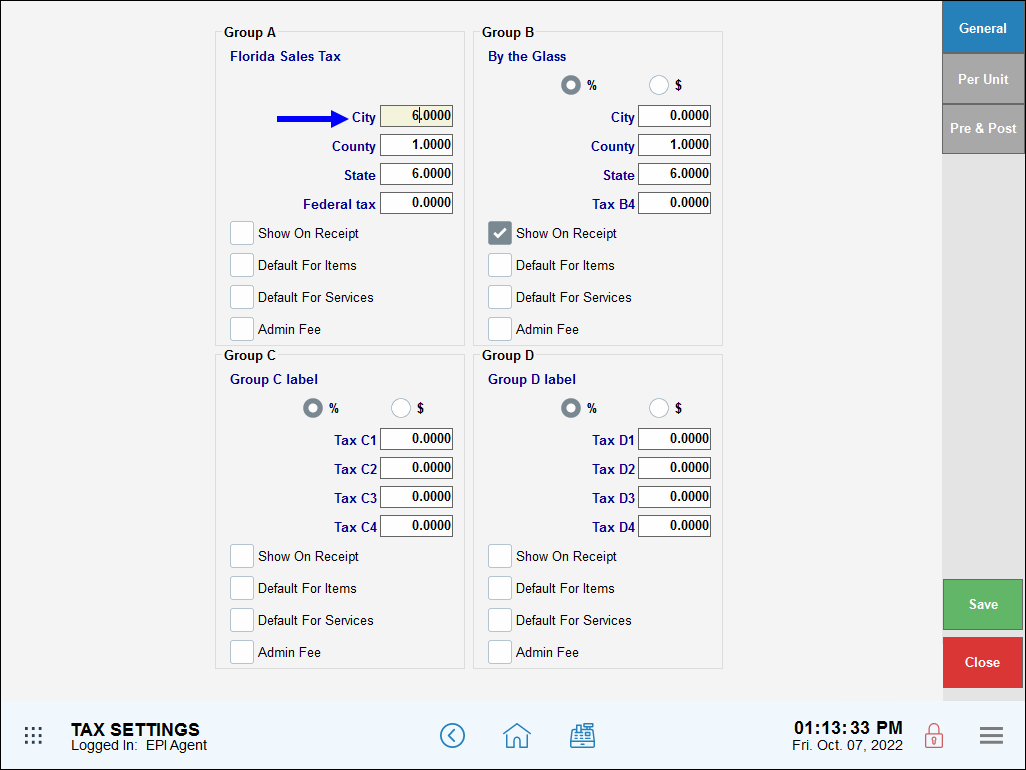

- Enter desired tax rates for each individual tax.

- Additional Tax Groups can be created by filling in tax rates for each group (i.e. Group B, Group C…)

- Tap Save.

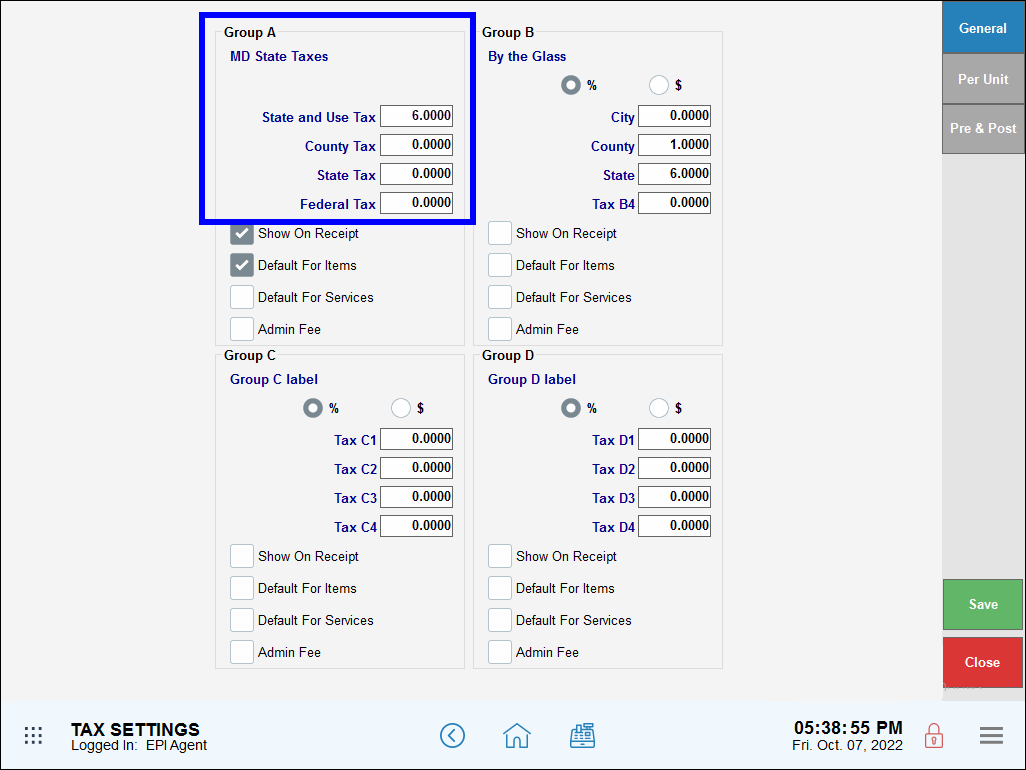

Tax Groups A-D can be customized according to your specifications.

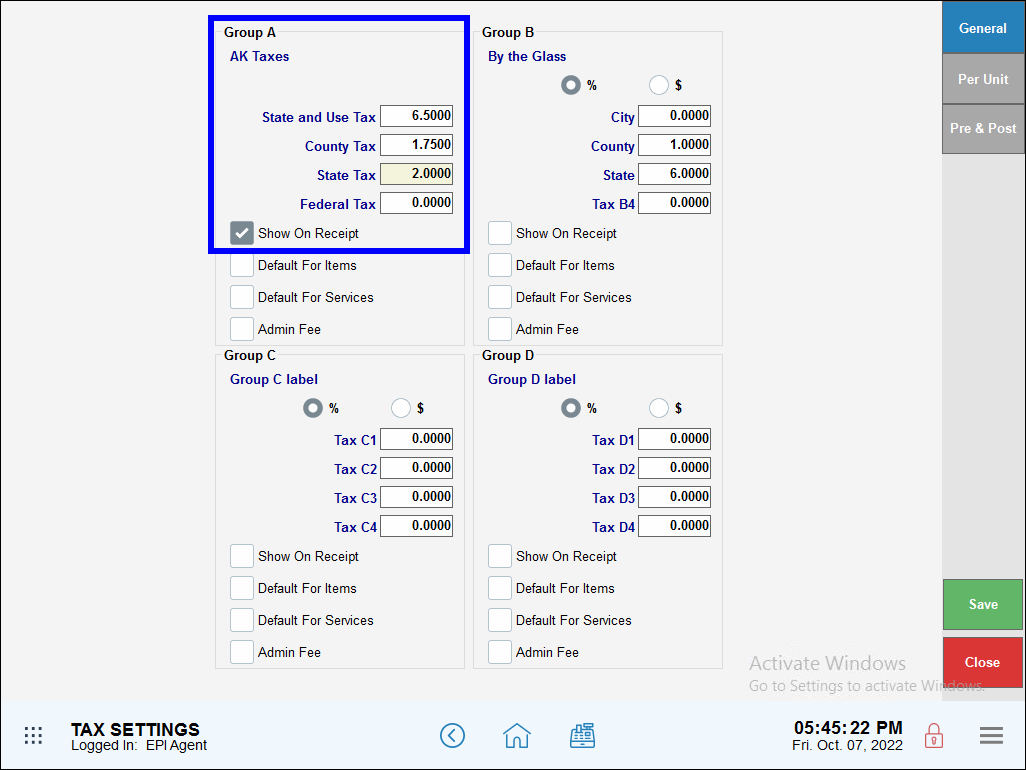

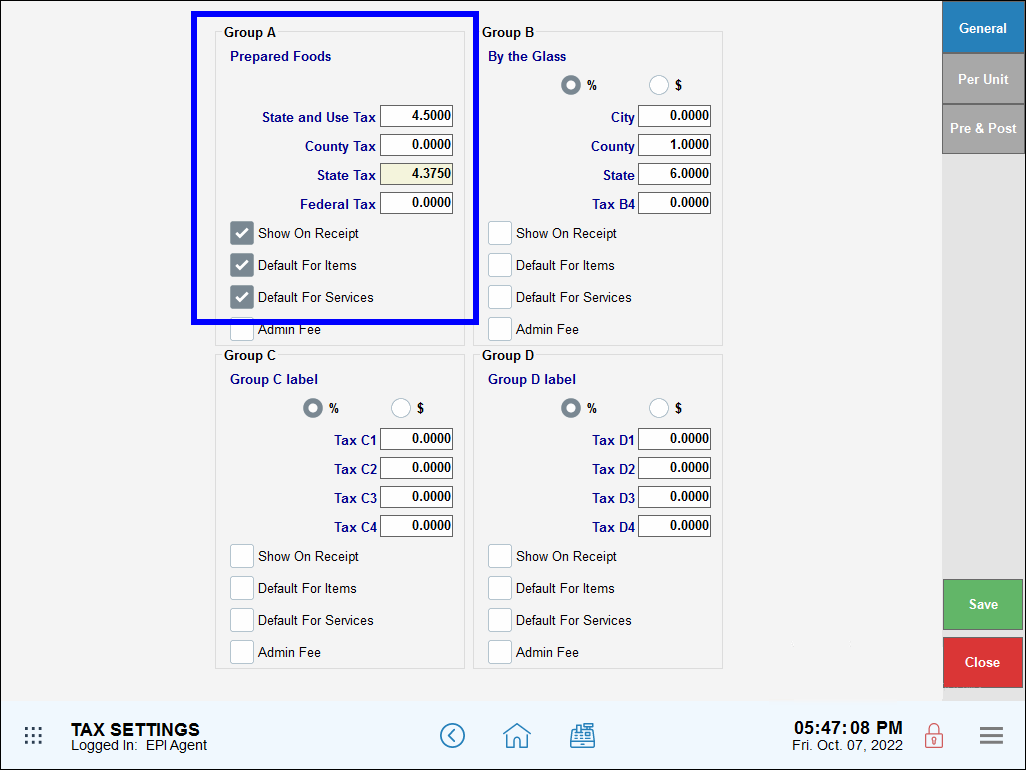

- Show On Receipt: Select to display the tax details on customer receipt.

- Default For Items: Select this check box to apply the Group’s tax rules to all items. Different tax rules can be applied later to individual items. See: Set Tax Rate for an Individual Item

- Default For Services: Select this check box to apply the Group’s tax rules to all services. Different tax rules can be applied later to individual services. See: Set Tax Rate for an Individual Service

- Admin Fee: A fee implemented by retailers, restaurants and other businesses to help with business expenditures, maintain exceptional service, and provide competitive prices.

- Tip! Just as you can apply multiple tax rates to a single item, you can apply multiple Tax Groups as your System Default. For example, you can check Default For Items in both Group A and Group B.

- Note: Examples below are instructional only and should not be used as tax advice. Consult with your state’s department of revenue and/or your knowledgeable sales tax accountant to determine how to apply taxes in your location.

- Tax on water bottles in Maryland convenience stores: 6.00% Sales and Use tax.

- Tax on clothing in a Batesville, AK retail boutique: 6.5% State tax rate, 1.75% County tax rate, 2% City tax rate.

- Tax on prepared, hot food items in a New York City, NY fresh market: 4.5% State tax, 4% Local sales and use tax, 0.375% Metropolitan Commuter Transportation District surcharge. Non-perishable grocery items are tax exempt. Only apply these taxes to prepared, hot foods.

How can we improve this information for you?

Registered internal users can comment. Merchants, have a suggestion? Tell us more.