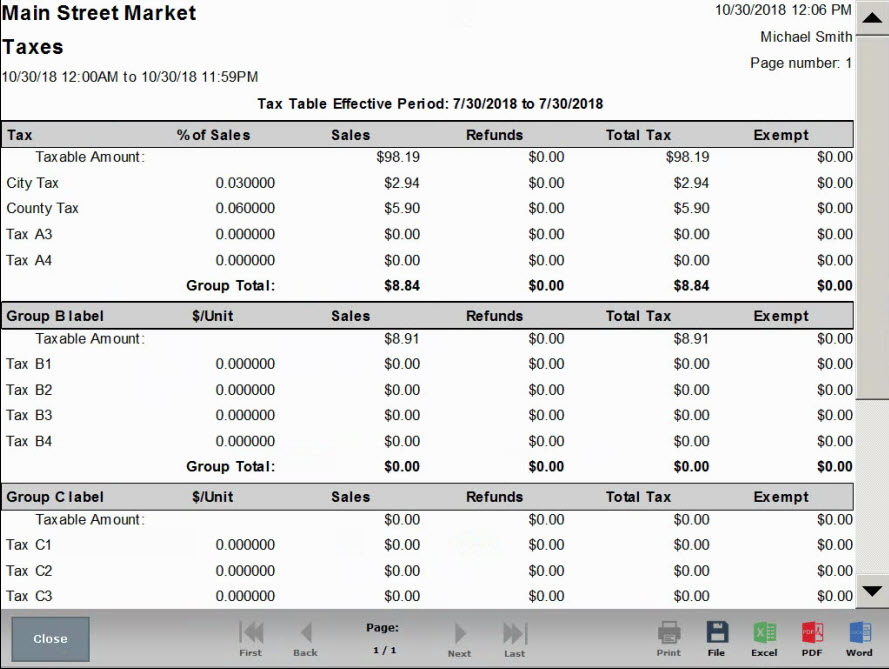

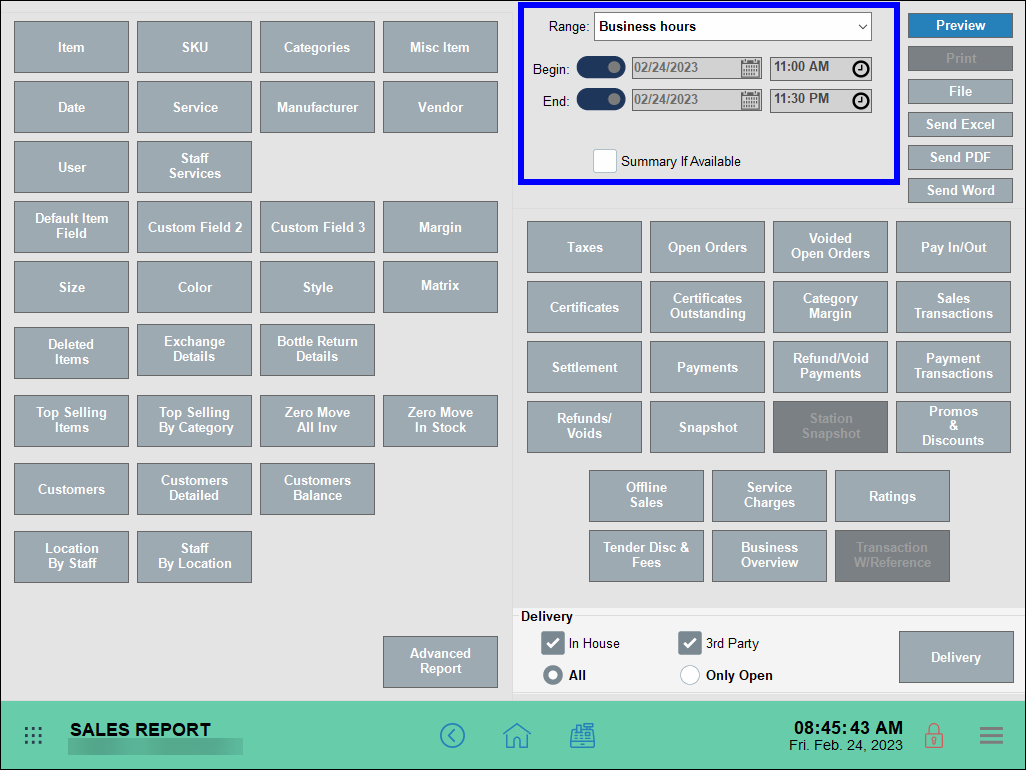

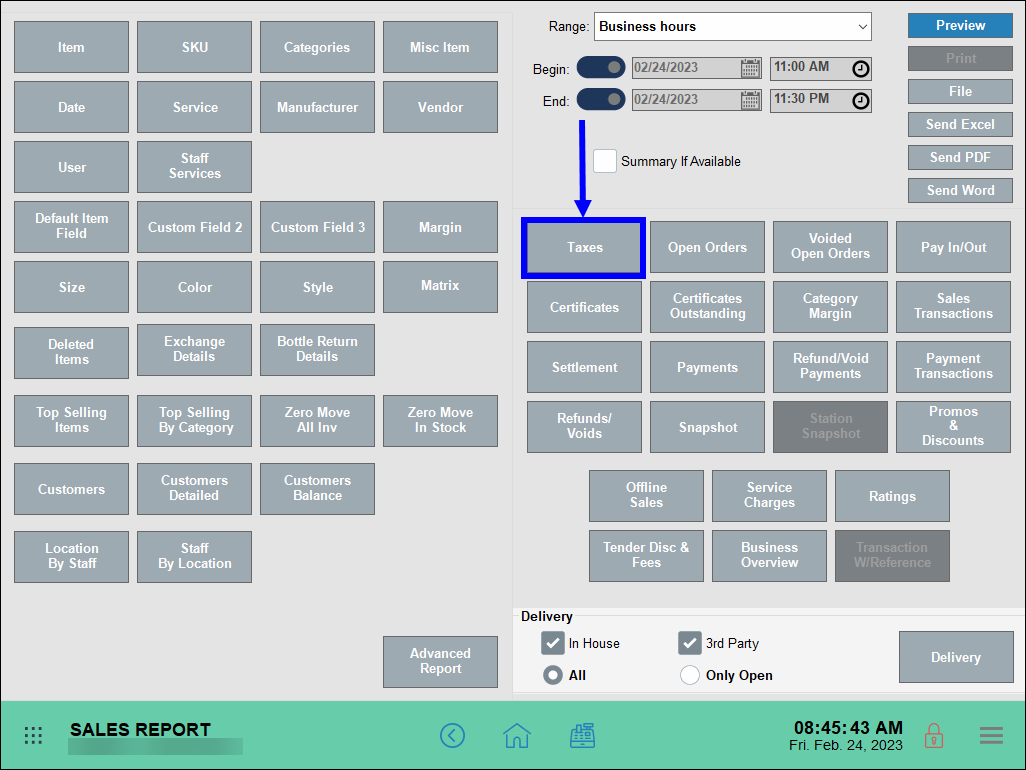

Get sales tax information! This financial report summarizes sales tax dollars collected, refunded taxes, total taxes, and taxes with an applied exemption.

- Group label: These are names of Tax Groups. If custom names were assigned, those names appear here.

- %/Unit: Taxes are calculated either by % of sale or $ per Unit. For example, Groups A, B, C, and D are General Taxes calculated according to “% sales”. Groups E, F and G are Per Unit taxes, and taxed according to “unit, gallon, or liter”.

- Sales: Displays sale amounts, before tax.

- Refunds: Tax refunds display here.

- Total Tax:

- Exempt: Tax-exemptions display here.

How can we improve this information for you?

Registered internal users can comment. Merchants, have a suggestion? Tell us more.